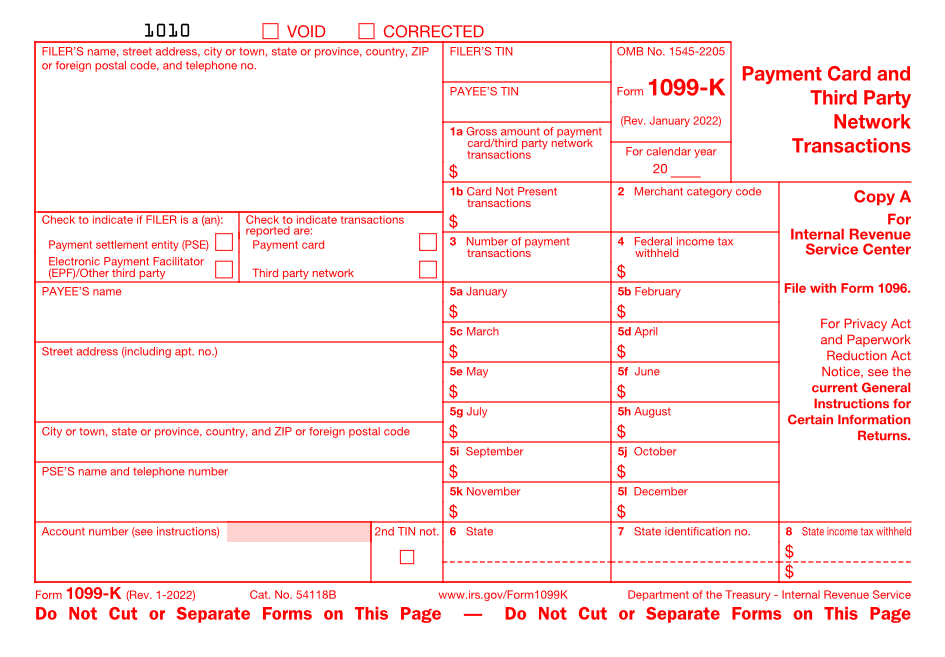

I predict that IRS will figure out a way to partially (or less likely, completely) waive the new 1099-K filing requirements for TY2022. By this I mean, just as they did repeatedly for three years after a law was passed requiring 1098-T Box 1 amounts to be filed by education institutions, they will waive penalties for failing to meet the filing requirement, perhaps based on a temporarily higher threshold (maybe $5K instead of $600).

My prediction is based on two things: one, it's going to become an even more contentious issue for the various political factions, especially in light of IRS' increased enforcement budget (roughly half of the $80,000M budget allocation from Inflation Reduction Act), and the IRS probably doesn't want to be innocent messenger in the middle, and two, they've shown how wimpy they are in the example I just mentioned, the 1098-T law that was essentially unenforced for 3 years by the IRS.

As a practical matter, I've received business payments for tax prep through Paypal that exceed the threshold this year, but as a long-time holder of a Paypal account, I don't think I've ever given them my SSN or EIN (but can't be sure). Similarly I have also received payments through Quickbooks payments, but those are all ACH debits, not credit card transactions, so I don't know if they are subject to reporting off the top of my head. But surely there are many others who have received reportable payments but don't have valid tax IDs on file with these payment processors.

Here is one article

And here is a discussion at a non-tax forum about how people in the tech industry are thinking about this:

https://news.ycombinator.com/item?id=32545466

My prediction is based on two things: one, it's going to become an even more contentious issue for the various political factions, especially in light of IRS' increased enforcement budget (roughly half of the $80,000M budget allocation from Inflation Reduction Act), and the IRS probably doesn't want to be innocent messenger in the middle, and two, they've shown how wimpy they are in the example I just mentioned, the 1098-T law that was essentially unenforced for 3 years by the IRS.

As a practical matter, I've received business payments for tax prep through Paypal that exceed the threshold this year, but as a long-time holder of a Paypal account, I don't think I've ever given them my SSN or EIN (but can't be sure). Similarly I have also received payments through Quickbooks payments, but those are all ACH debits, not credit card transactions, so I don't know if they are subject to reporting off the top of my head. But surely there are many others who have received reportable payments but don't have valid tax IDs on file with these payment processors.

Here is one article

"Not everyone is onboard with these changes. Organizations such as eBay are currently lobbying Congress to increase the threshold back to the original $20,000, though it’s unlikely to happen, since this change is part of the government’s way to pay for the American Rescue Plan Act. However, there is a bill in Congress right now that would raise the threshold from $600 to $5,000, but it’s unclear as to whether the bill, if passed, would impact the 2022 tax year."

https://news.ycombinator.com/item?id=32545466

"However, we have one massive problem: our merchants are not used to paying taxes and are deeply afraid of using our more monetized features because we are legally required to fill out a 1099-K on their behalf. It's one part "I don't want the government taking my money" to two parts "I don't know how taxes work" in most cases that we've looked into."

At this point I recommend to clients that we report it and back it out. Since VA dropped the threshold to $600, I've seen a fair amount of "garage sale" 1099-Ks from ebay. Clients have agreed to report it and back it out as "Personal property sold at a loss (xxx)". We'll see if that helps or hurts, audit periods are still open. If clients don't want to report and back-out, I recommend that we include a statement to the effect of $xxx reported on 1099-K from ebay was for personal property sold at a loss". I'm confident that nobody at the IRS reads that stuff but then it might be easier to make AUR go away by replying "As stated on the original return . . ."

At this point I recommend to clients that we report it and back it out. Since VA dropped the threshold to $600, I've seen a fair amount of "garage sale" 1099-Ks from ebay. Clients have agreed to report it and back it out as "Personal property sold at a loss (xxx)". We'll see if that helps or hurts, audit periods are still open. If clients don't want to report and back-out, I recommend that we include a statement to the effect of $xxx reported on 1099-K from ebay was for personal property sold at a loss". I'm confident that nobody at the IRS reads that stuff but then it might be easier to make AUR go away by replying "As stated on the original return . . ."

Comment