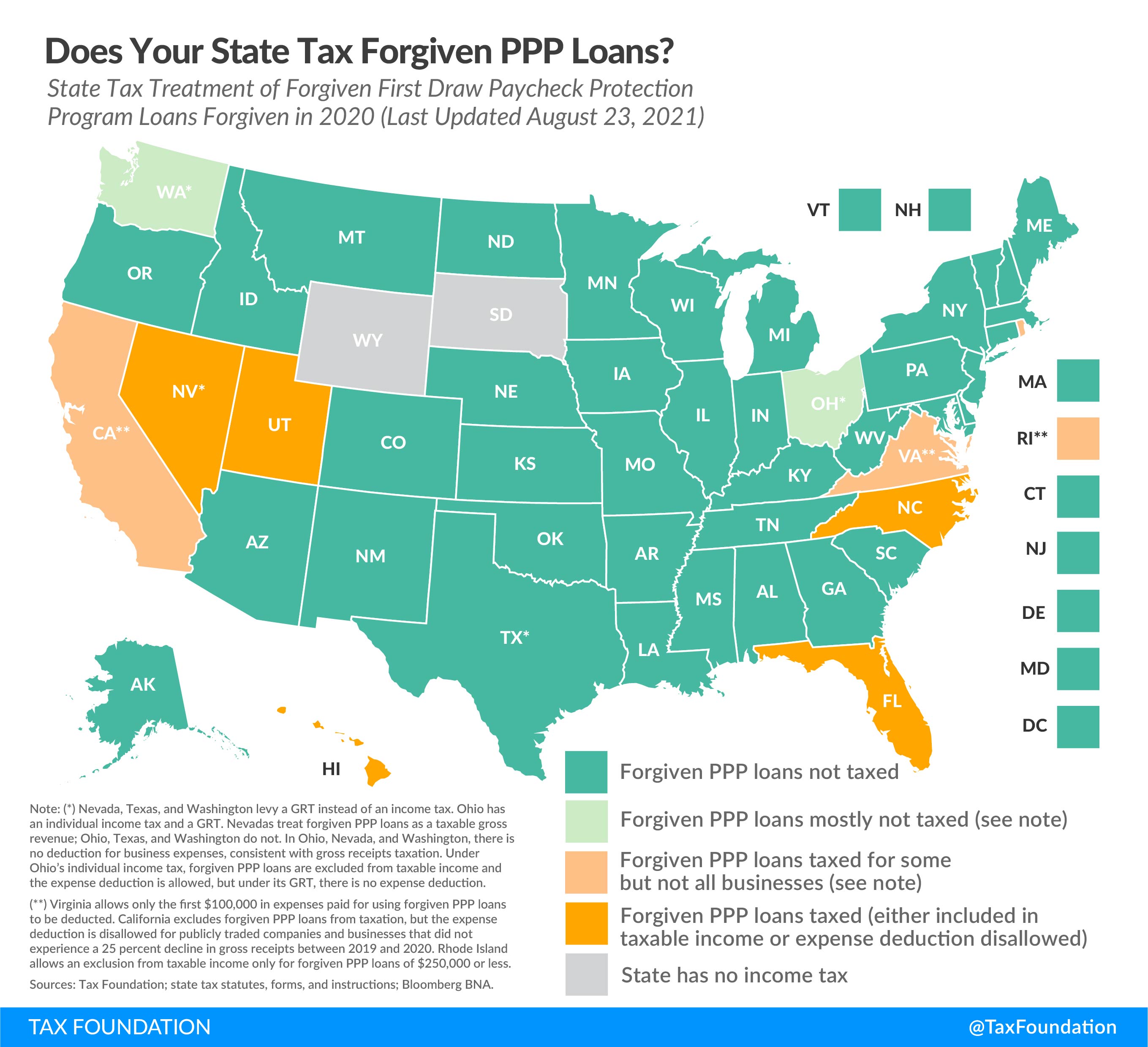

Does any body know if PPP taxable income for all states ?

PPP forgivess taxable for all States

Collapse

X

-

No it's not taxable for all states."Taxation is the price we pay for failing to build a civilized society." ~ Mark Skousen -

Important information for taxpayers

from the Massachusetts Department of RevenuePPP loan forgiveness income

New trustee tax advance payment date

New trustee tax return filing dateTelecommuter information

Sales suppression software penalties

Partnerships subject to federal auditPlease take some time to review these important tax matters, which could have an impact on your tax compliance. Many of the provisions summarized here were included in the Commonwealth’s FY21 budget.

Information will be updated on these items as it is available on Hot Topics. Please bookmark the link to check back for additional information.

PPP loan forgiveness income

The CARES Act provides that any cancelled indebtedness from the Paycheck Protection Program is excluded from gross income for federal income tax purposes. As you may know, legislation is currently pending that would change the rules about the Massachusetts tax treatment and reporting of forgiven PPP loan income. If the legislation passes, we will update the information on the FAQ webpage.

Comment

Disclaimer

Collapse

This message board allows participants to freely exchange ideas and opinions on areas concerning taxes. The comments posted are the opinions of participants and not that of Tax Materials, Inc. We make no claim as to the accuracy of the information and will not be held liable for any damages caused by using such information. Tax Materials, Inc. reserves the right to delete or modify inappropriate postings.

Comment