Just wondering how many of you realize the Tuition and Fees deduction and the Sales Tax deduction expired December 31, 2005, and Congress has yet to re-instate them.

Expiring Provisions

Collapse

X

-

Tags: None

-

Jan

Jan

I read it in someone’s update and notice that it wasn’t in the 2006 drafts form 1040 and Sch. A

Comment

-

Originally posted by veritasI agree on the sales tax. It really isn't fair you don't get some deduction.

Thankyou Veritas, now if I could find somone to give me a little cheese with my whine...

BTW , What does Veritas stand for ? ( SEA-tax) I do taxes and from around seattle.

I was just wondering, does it mean "right or true " in say french.Comment

-

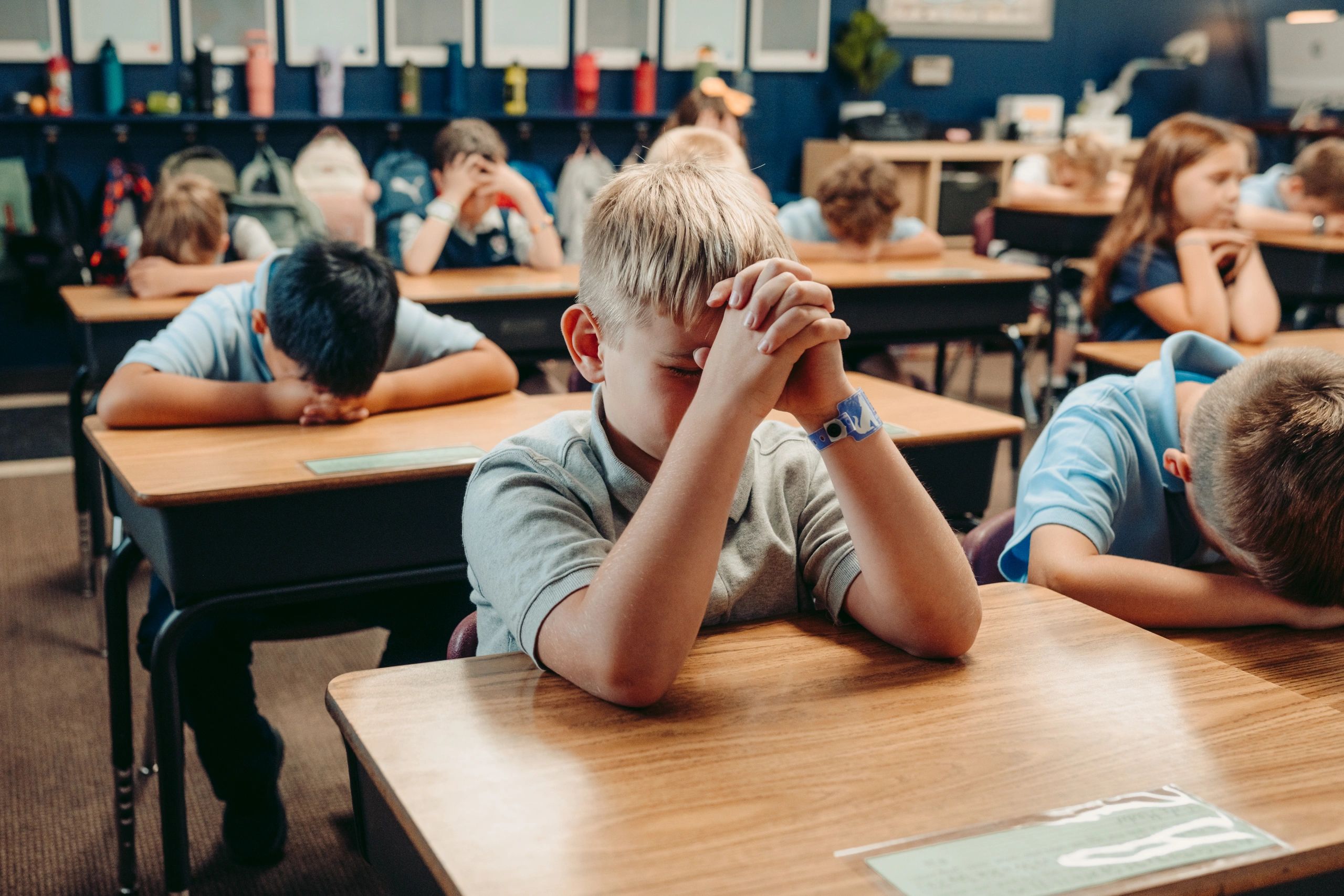

it is latin for truth. It's also the name of my son's school.

Last edited by veritas; 08-09-2006, 08:17 PM.Comment

-

Subject Matter

Sea-tax and Veritas, if I tried to scuttle the original message about tuition exemption, I couldn't have done a better job than you two did. Eight posts, and nothing about the original thread. Oh well, not the first time this has happened, nor will it be the last.

For some reason, this matter about tuition exemption has only been a temporary measure and has been expiring at selected times ever since the 1970s. I don't think there has been a time, at least not in the last 30 years, that the exemption was ever not in effect. It has been extended every time -- at least up until 2006 and the fat lady has not sung yet.

What we DO know is as follows: if the measure is not extended, employers won't know the difference. Tuition refund has been tax-free forever, and employers are not keeping up with whether or not it will be extended.

Now the big question if the exemption dies: What is OUR responsibility if an employee comes to us to fill out his tax return...He tells us that his employer has paid him $2500 in tuition refund. Employer has NOT increased his W-2. Should we take the position that the responsibility is the employers and not report this as income for the employee?

I don't think we can as professionals. However, the proverbial "guy across town" will ignore this in a heartbeat. And we will lose this customer to the "guy across town."

The easy solution is that the customer simply doesn't tell you about the tuition refund.

Then you have no obligation. The customer pays me by the hour, and I won't spend his money trying to uncover unreported income -- I'll spend my time trying to find deductions. If I run smack into income, I'm obligated to report it, but I won't look under rocks to find it.Comment

-

Unregistered

Unregistered

It appears snaggletooth is confusing the tuition & fees deduction with the employer educational assistance programs. It is the $4,000 ($2,000 in higher AGI) adjustment to gross income that has expired.Comment

-

Sorry Snags , I can't speak for Veritas but it was never my intention to scuttle as you say the posting.

I will point out however that both of us did answer or comment about the question and it was not 8 postings to do this . We got of topic for only 4 or so.

Anyways like I said sorry , I just was interested in how some of you all came up with such interesting names.Comment

-

Unless you're going to audit the employer's payroll records, I don't believe it's a tax preparer's role to blow the whistle on the employer/employee and report the income. How often do clients have a misunderstanding about how they're paid and how it's reported? Most of the time. You'd have to go much deeper than merely taking a client's word that "I got paid $2,500 for tuition" and sticking it on the return. You'd have to delve into the payroll records to see exactly what happened. Do you really want to do that?Originally posted by SnaggletoothWhat is OUR responsibility if an employee comes to us to fill out his tax return...He tells us that his employer has paid him $2500 in tuition refund. Employer has NOT increased his W-2. Should we take the position that the responsibility is the employers and not report this as income for the employee?

In cases like that I say "In my experience that's taxable and I would have reported it." Let the client know you're not responsible if it pops up later and causes a problem. Then move on.

I had a client a few years ago who became disabled and was collecting disability insurance. The premiums were a combination of employer-paid and an additional amount the employee paid after tax. My research told me that part of the disability payments would be taxable, and part would not. The insurance company reported the payments as 100% nontaxable. We're talking big dollars. I had previously worked up the percentage that would be taxable, so I was covered as far as a paper trail showing my advice. I told the client I would have reported it differently, but I don't know everything and if he wanted to go with the insurance company's reporting I wouldn't interfere.

I think if you're going to get involved with the way someone else reports payroll, you'd better be ready to jump in with both feet.Comment

-

Ahoy matey!Originally posted by SnaggletoothSea-tax and Veritas, if I tried to scuttle the original message about tuition exemption, I couldn't have done a better job than you two did. Eight posts, and nothing about the original thread. Oh well, not the first time this has happened, nor will it be the last.

For some reason, this matter about tuition exemption has only been a temporary measure and has been expiring at selected times ever since the 1970s. I don't think there has been a time, at least not in the last 30 years, that the exemption was ever not in effect. It has been extended every time -- at least up until 2006 and the fat lady has not sung yet.

What we DO know is as follows: if the measure is not extended, employers won't know the difference. Tuition refund has been tax-free forever, and employers are not keeping up with whether or not it will be extended.

Now the big question if the exemption dies: What is OUR responsibility if an employee comes to us to fill out his tax return...He tells us that his employer has paid him $2500 in tuition refund. Employer has NOT increased his W-2. Should we take the position that the responsibility is the employers and not report this as income for the employee?

I don't think we can as professionals. However, the proverbial "guy across town" will ignore this in a heartbeat. And we will lose this customer to the "guy across town."

The easy solution is that the customer simply doesn't tell you about the tuition refund.

Then you have no obligation. The customer pays me by the hour, and I won't spend his money trying to uncover unreported income -- I'll spend my time trying to find deductions. If I run smack into income, I'm obligated to report it, but I won't look under rocks to find it.

Hey "scuttle" isn't that pirate talk?Comment

-

Snaggletoof

Snaggletoof

Confused

I didn't read the original post from BeesWax very well. I DID, in fact, think he was talking about the tax-free employee benefit and not the adjustment line on the taxpayers' return. Also the banter between Veritas and Sea-Sick was about the sales tax deduction, since Oregon doesn't have one I think, so I was hardly in synch with their messages either.

Be that as it may, Veritas and Sea-Tax, I still enjoy being ornery every now and then. Live with it!

...and have fun with me...Comment

Disclaimer

Collapse

This message board allows participants to freely exchange ideas and opinions on areas concerning taxes. The comments posted are the opinions of participants and not that of Tax Materials, Inc. We make no claim as to the accuracy of the information and will not be held liable for any damages caused by using such information. Tax Materials, Inc. reserves the right to delete or modify inappropriate postings.

Comment